The HDFC Diversified Equity All Cap Active FOF – NFO has been launched to provide investors with exposure across large-cap, mid-cap, and small-cap funds. This New Fund Offering aims to create long-term wealth by investing in actively managed equity mutual funds. Investors looking for diversification across all market caps can consider this new opportunity. In this article, we explore its features, benefits, risks, and whether it deserves a place in your portfolio.

What is HDFC Diversified Equity All Cap Active FOF – NFO?

The HDFC Diversified Equity All Cap Active FOF – NFO is a Fund of Fund (FOF) scheme. This means it does not invest directly in stocks but instead invests in other equity mutual funds.

The scheme’s goal is to provide diversification across market caps:

Large-cap funds for stability.

Mid-cap funds for growth potential.

Small-cap funds for aggressive wealth creation.

By combining these, the fund seeks to balance risk and return effectively.

Key Features of HDFC Diversified Equity All Cap Active FOF

Here are the main highlights:

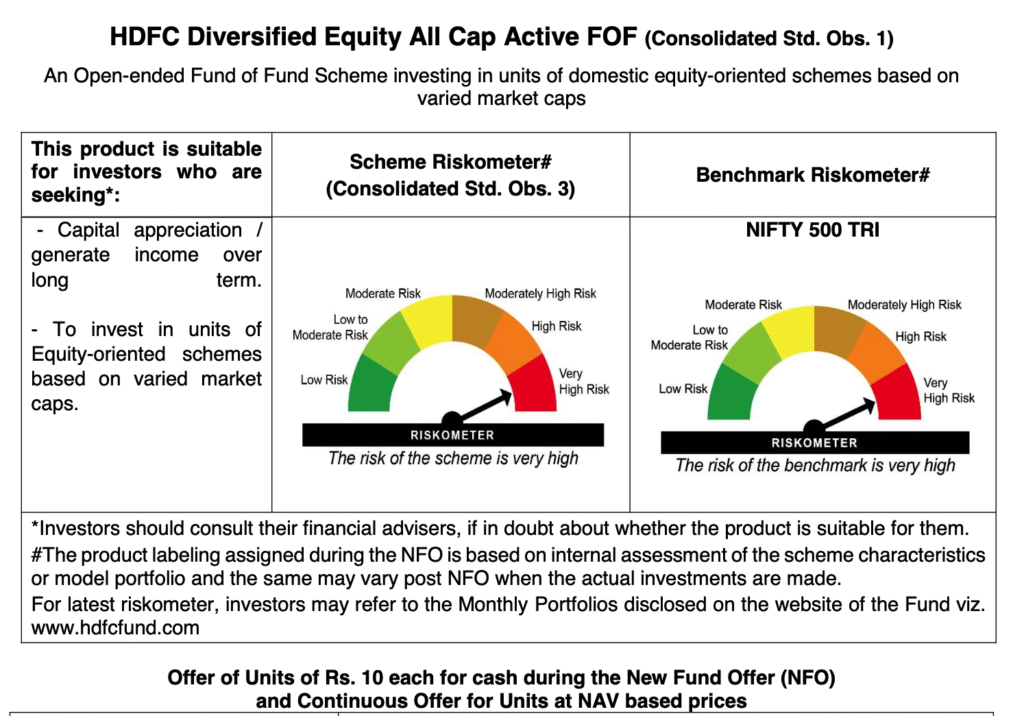

Fund Type: Open-ended Fund of Fund Scheme.

Investment Objective: Long-term capital appreciation through allocation across large, mid, and small-cap active equity funds.

Benchmark: A blended benchmark representing large, mid, and small-cap indices.

Minimum Investment: ₹5,000 during the NFO period.

Risk Profile: High risk, since it invests in equities.

Fund Manager: Experienced managers from HDFC Mutual Fund with proven track records.

Why Consider This Fund?

Diversification Across Market Caps

Investors often struggle to choose between large-cap, mid-cap, and small-cap funds. This fund offers a simple solution by combining all three in one portfolio.Active Management Advantage

The scheme invests in actively managed funds. This gives investors the benefit of professional fund management and research-driven strategies.One-Stop Solution

Instead of buying multiple equity funds, investors can gain exposure through one product. This reduces the need for portfolio tracking across multiple schemes.Potential for Higher Returns

Small and mid-cap exposure can boost long-term returns if markets perform well.

Risks Involved

Every investment has risks, and the HDFC Diversified Equity All Cap Active FOF – NFO is no exception.

Market Volatility: Mid and small-cap funds are more volatile compared to large-cap funds.

Over-diversification: Being a Fund of Funds, expenses may be slightly higher compared to a direct multi-cap fund.

No Guaranteed Returns: Performance depends on the underlying active equity schemes.

Who Should Invest in This Fund?

The fund is suitable for:

Investors looking for long-term wealth creation.

Those who want exposure to all market caps but prefer a single scheme.

Individuals with moderate to high risk tolerance.

Investors who lack time or expertise to select multiple equity schemes.

Not suitable for:

Short-term investors.

Conservative investors with low risk appetite.

How Does it Compare to Other Funds?

Unlike a Multi-Cap Fund that directly invests in equities, this FOF invests in multiple existing mutual funds. The advantage is professional fund selection. However, the cost could be slightly higher due to dual expense structures.

Investors should compare it with multi-cap funds and flexi-cap funds before making a decision.

NFO Details

Scheme Name: HDFC Diversified Equity All Cap Active FOF – NFO

NFO Period: [Insert Actual Dates]

Minimum Application Amount: ₹5,000

SIP Facility: Available post NFO

Exit Load: As per scheme details

FAQs

1. What is a Fund of Funds (FOF)?

A Fund of Funds is a scheme that invests in other mutual funds instead of directly investing in stocks or bonds.

2. Is HDFC Diversified Equity All Cap Active FOF risky?

Yes, since it invests in equity funds, it carries high risk. However, diversification helps balance the risk.

3. Can I start a SIP in this NFO?

Yes, SIP option will be available once the NFO converts into a regular open-ended scheme.

4. How is this different from a Multi-Cap Fund?

A Multi-Cap Fund directly invests in stocks across market caps, while this FOF invests in other equity funds.

5. What is the minimum investment amount?

The minimum investment during the NFO is ₹5,000.

6. Should beginners invest in this NFO?

Yes, beginners who want exposure to all market caps but lack knowledge of fund selection can benefit.