Invest with Confidence

Start with a SIP in best funds to create your future secure and financial free.

Take control of your financial freedom.

Choose The Right Asset Allocation

SIP

Debt

Bond

Equity

Elss

Shares

Why Right Asset Allocation is so Important?

Chossing the right asset allocation Is the most important while investing especially when you are new to investments. It depends on several factors including your investment goals, risk tolerance, time horizon, and financial situation.

Here’s a basic plan to figure out the appropriate asset allocation:

1. Define Your Financial Goals

Be clear why you're investing for (e.g., retirement, education, buying a house) and when you'll need the money.

3. Understand Asset Classes

Stocks (Equities) Historically, they offer higher returns over the long term but come with higher volatility and risk.

Bonds (Fixed-Income) Generally offer lower returns but provide income and tend to be less volatile than stocks.

Cash and Cash Equivalents Provide stability and liquidity but typically offer lower returns than stocks and bonds.

5. Consider Your Time Horizon

Longer time horizons typically allow for a greater allocation to stocks since you have more time to ride out market fluctuations.

Shorter time horizons may require a larger allocation to less volatile assets like bonds or cash.

2. Assess Your Risk Tolerance

Consider how comfortable you are with the possibility of losing money in the short term. Are you willing to take on more risk for potentially higher returns, or do you prefer more stability even if it means lower potential returns?

4. Diversification

Spread your investments across different asset classes to reduce risk. Diversification can help smooth out investment returns over time.

6. Rebalance Regularly

Periodically review your portfolio to ensure it remains aligned with your goals and risk tolerance. Rebalance by selling assets that have performed well and buying assets that are underperforming to maintain your desired asset allocation.

Simple steps to Invest

What We Do

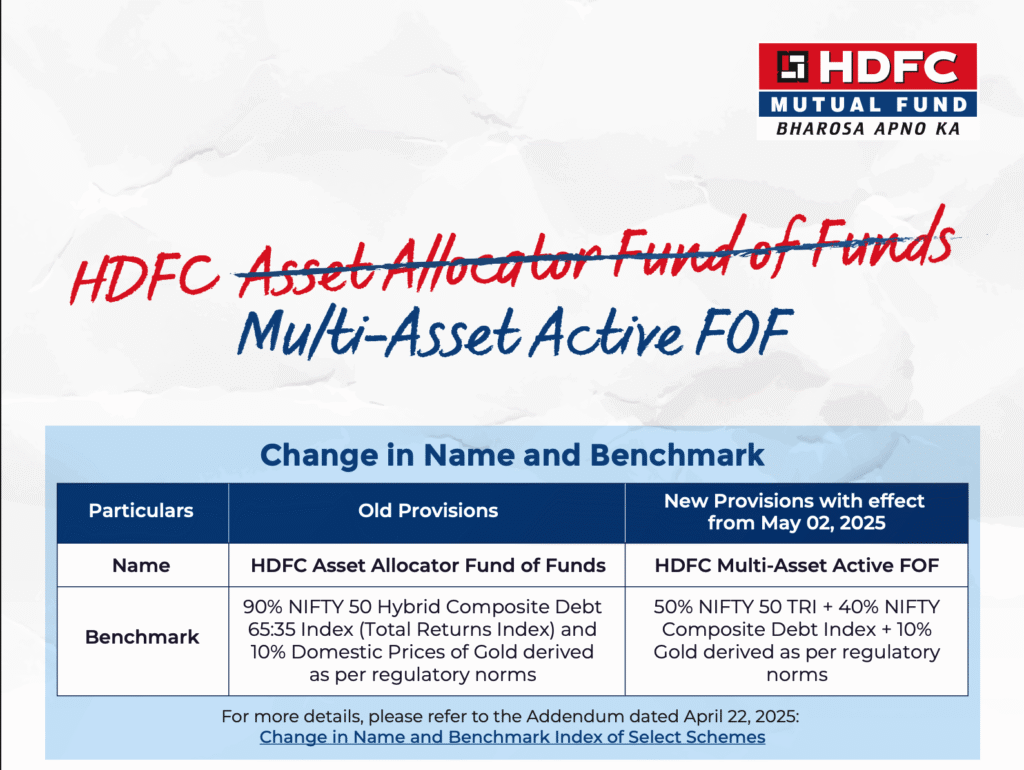

Right asset allocation

We help you to chose right asset allocation based on your financial goals and time horizon.

Chosing Best Suitable funds

We help you to chose right asset allocation based on your financial goals and time horizon.

Monitering and Rebalancing

We check fund performance on regular intervals to achive financial goals

What You Do

Just focus on your Job

Let us take care of your investments and you do focus on your carrer growth

Focus on your financial goals

Just focus on your goals and Top-up your investments on regular besis.

Keep Investing

Remember investing is the key of wealth creation.